1. First insights – outline of the current market situation

The connected TV1 market has great potential for growth, not only in the U.S. but also in Europe. Major factors driving the growth of the connected TV (CTV) market include increasing internet penetration, rapid technological progress, falling product prices for new devices, and the digital transformation of the media industry.

1“Connected TV” (CTV) is understood as an umbrella term for devices that are connected to the internet and enable users to consume TV content. This content tends to be watched in a “living-room” environment, with the device being only connected to the relevant household. The term encompasses not only smart TVs but also set-top boxes, TV sticks, and even some game consoles.

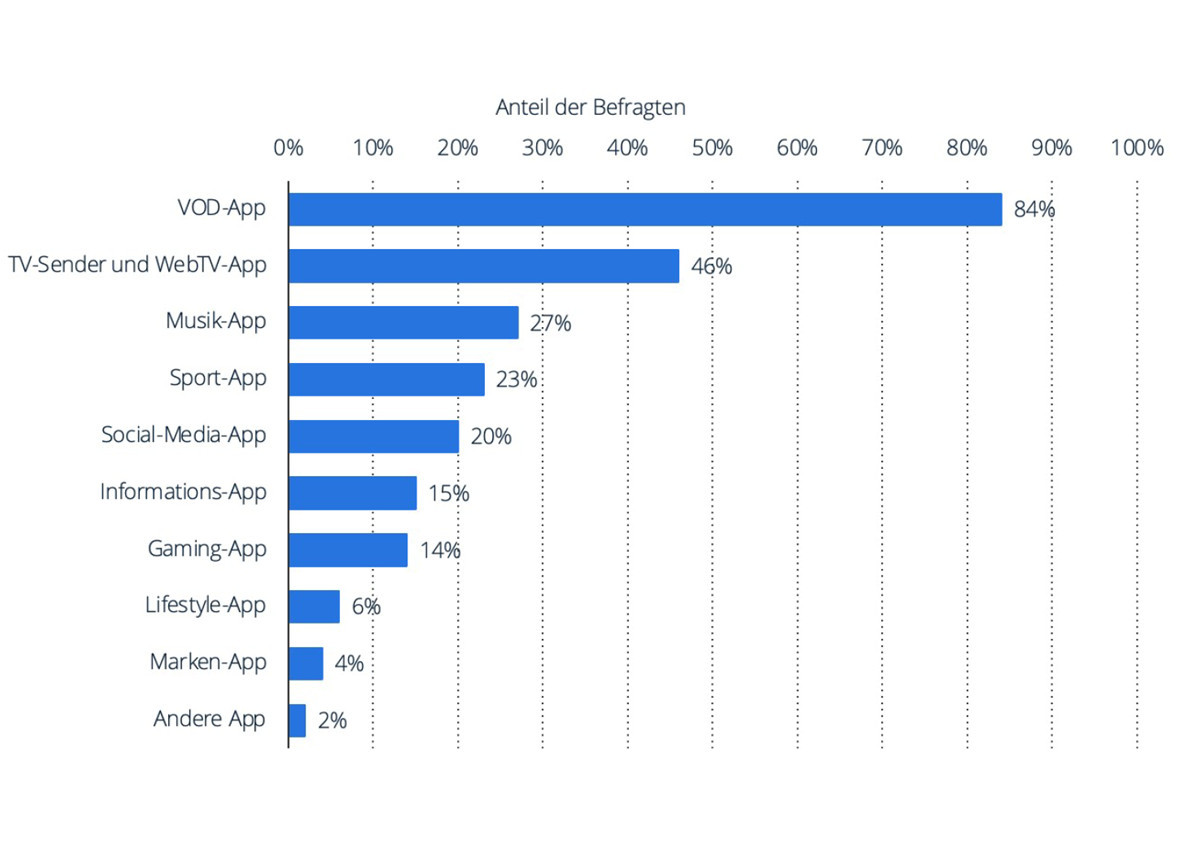

MANUFACTURERS of connected TVs are competing to offer the latest innovations when it comes to the user interface, the aggregation of content, and the development of apps, e.g., for connected TVs, which are equipped with an operating system that can run apps and widgets, stream videos and music, or serve as an eCommerce platform. There is hardly a more exciting platform, with the possible exception of the metaverse and connected cars.

APP DEVELOPERS make use of the connectivity of new devices and the possibilities of interacting with the actual TV program. The current features of connected TVs enable users to find, share, and/or download content, to chat with one another, to interact, to date, and to engage in any other type of communication. The availability of content that users can consume on their connected TVs has contributed significantly to the increase in the demand for devices and, consequently, their growing reach.

BROADCASTERS AND CONTENT PROVIDERS such as Apple TV, Amazon Fire TV, and Google Chromecast are transforming users’ viewing experience. Manufacturers often collaborate with over-the-top (OTT) content providers and vendors of OTT devices so that they can offer various functions which no longer require a set-top box. Connected TVs thus enable users to run apps that were formerly developed for smartphones. This, in turn, increases interactivity and makes the devices more attractive to consumers. Accordingly, usage times for connected TVs are increasing significantly, whereas those for the conventional internet are somewhat stagnant.

Moreover, the COVID-19 crisis has further accelerated the increase in usage times and reach. Lockdowns and work-from-home measures have boosted at-home video consumption to unprecedented heights: Video streaming platforms such as Netflix and Amazon Prime Video as well as local providers such as RTL+ in Germany have thus seen viewership skyrocket.

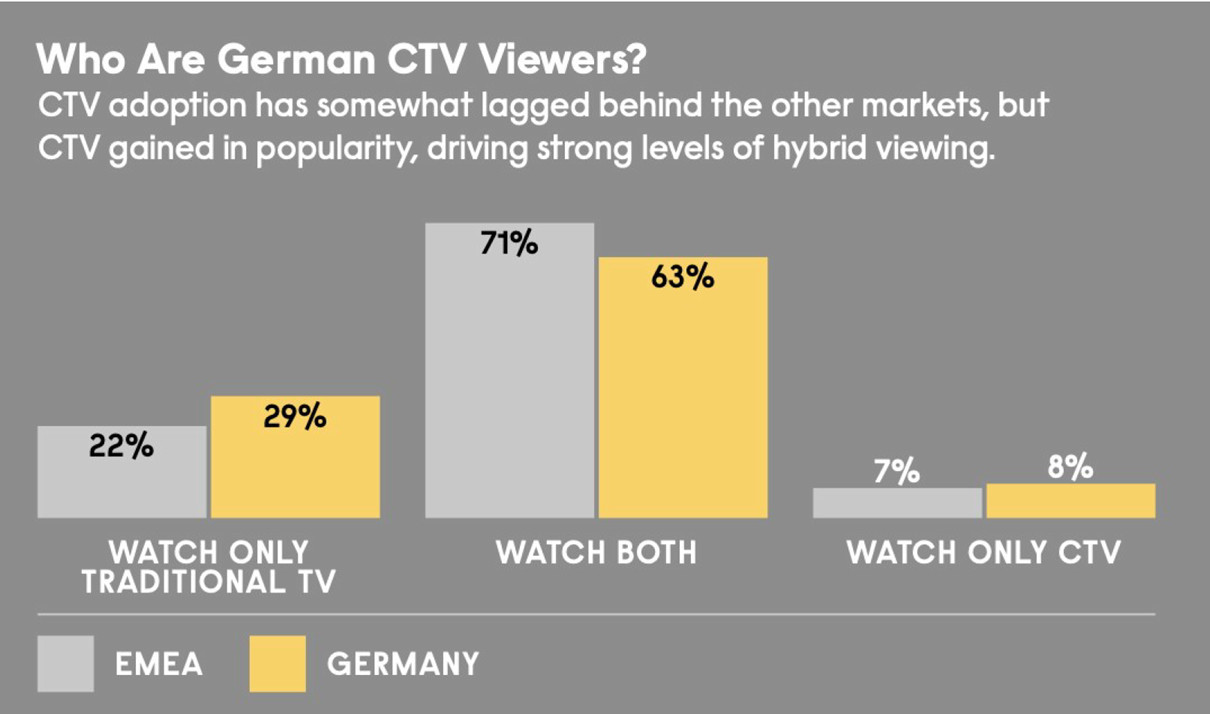

So-called “hybrid TV viewing” has become the new normal. A study by Magnite and Statista found that, nowadays, 71% of European viewers consume a combination of traditional TV and connected TV content. 30% of households stated that they primarily watched CTV content. In contrast, only 22% exclusively watched traditional television.CTV users are increasingly both watching traditional TV and interacting with CTV content: