Embedding in the European context

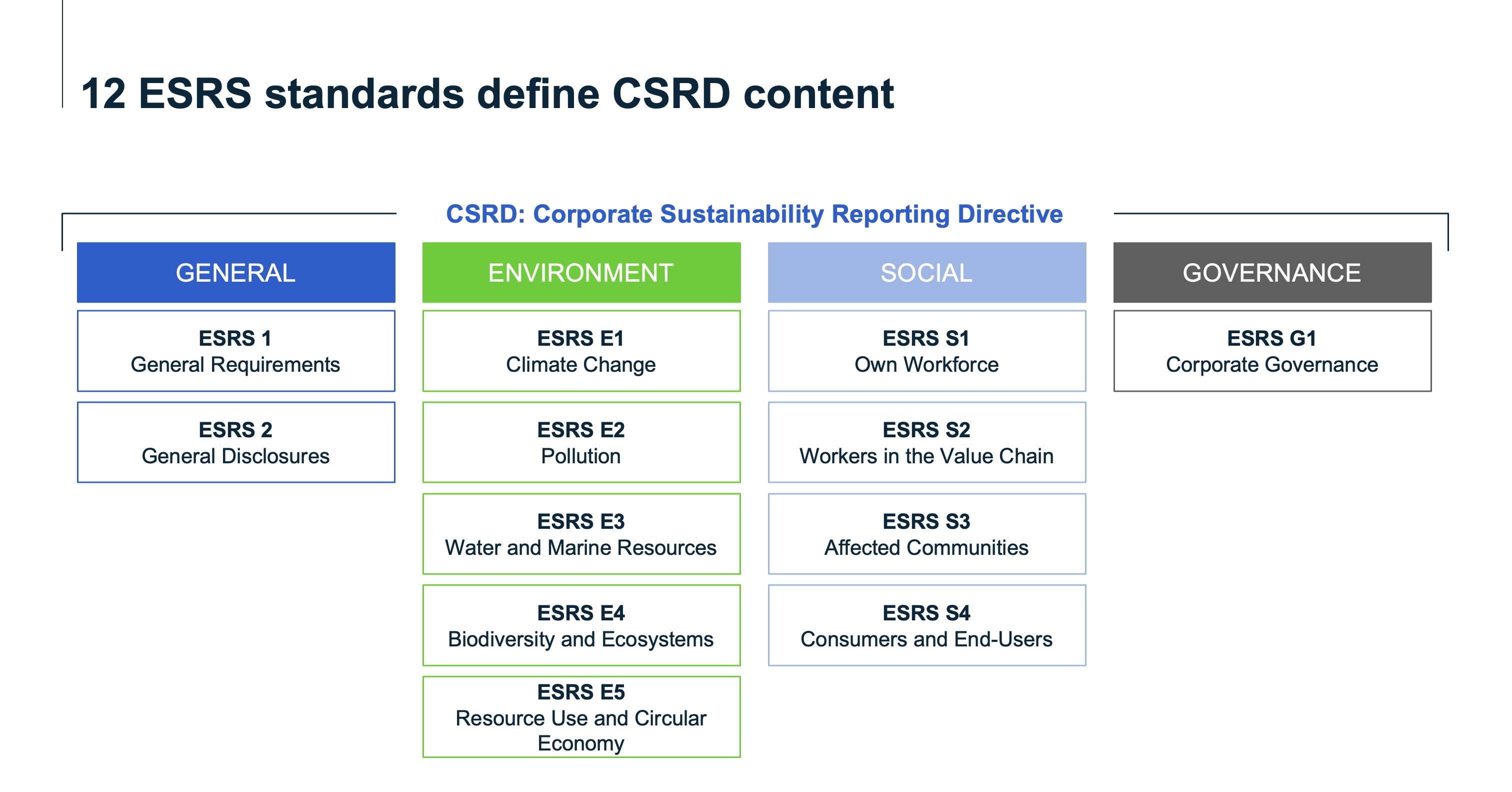

The Corporate Sustainability Reporting Directive (CSRD) is a new European directive that sets the framework for corporate sustainability reporting. It is part of the European Green Deal, a comprehensive EU strategy aimed at achieving climate neutrality by 2050.

The CSRD replaces the previous Non-Financial Reporting Directive (NFRD) and significantly tightens requirements for the disclosure of sustainability data. While the NFRD required only a limited number of companies to report, the CSRD significantly expands the scope of affected companies. From 2025, up to 50,000 companies in the EU and around 13,000 companies in Germany will be subject to the new reporting obligations.