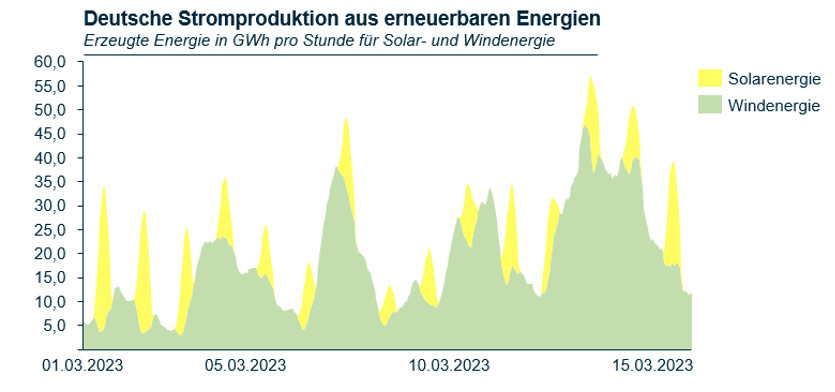

With the shutdown of fossil fuels, these fluctuations can no longer be balanced out at all times and Germany is dependent on imports from other European countries to cover its electricity requirements.

How European electricity markets influence each other

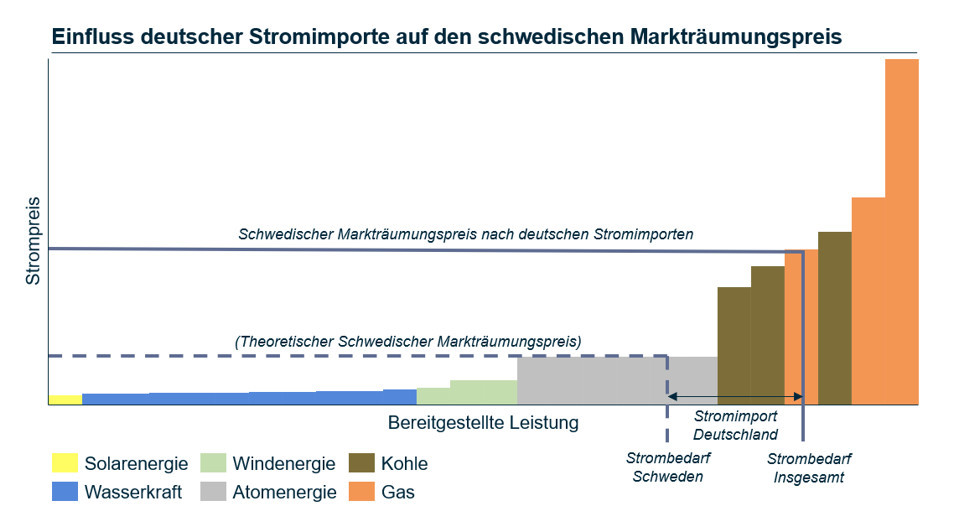

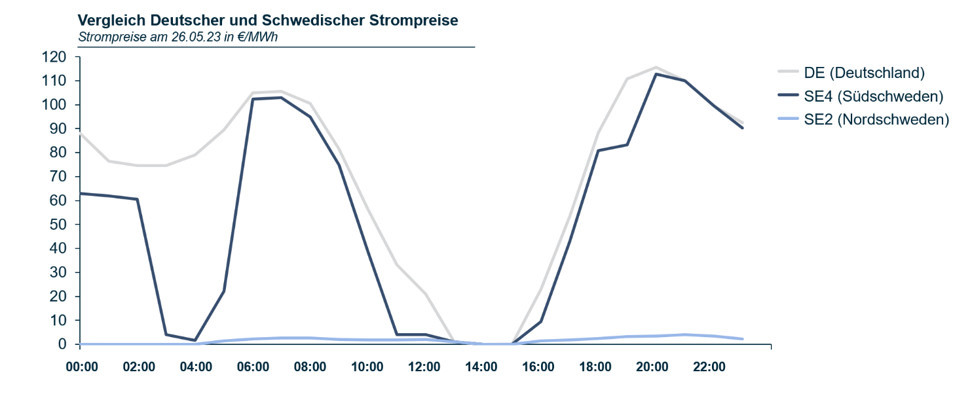

Since the liberalization of the power markets at the latest, electricity in Europe has been regarded as a commodity that can be freely traded on the national and international power exchanges. The price is essentially determined by the relationship between supply and demand. Power producers place hourly bids on the exchanges to determine the amount of electricity they can make available for the hour in question and at what price. According to the merit order principle, the offers are then sorted according to their variable costs, with the cheapest being awarded first until the demand for electricity is met for that hour. The most expensive bid that is just needed to meet the electricity demand determines the market clearing price. All winning bids for that hour are settled at the market clearing price and remunerated accordingly. While renewable energies such as wind and solar energy are characterized by particularly low variable costs, these are especially high for fossil fuels. Local differences in supply and demand can be automatically balanced between individual regions depending on the available transmission capacity. If the volatile electricity production in Germany is therefore currently not sufficient to meet its demand, this must automatically be met by available capacities in Sweden. While Sweden possesses a reliable renewable power supply for its own needs and could benefit from their low production costs, meeting Germany’s volatile electricity demand still required the use of cost-intensive production methods. These increase the price for which all Swedish electricity production is traded via the market clearing principle.